Georgia tax paycheck calculator

Georgia Income Tax Calculator 2021 If you make 70000 a year living in the region of Georgia USA you will be taxed 11993. Just enter the wages tax withholdings and other information required.

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

For example if an employee receives 500 in take-home pay this calculator can be.

. This free easy to use payroll calculator will calculate your take home pay. For 2022 tax year. All you have to do.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax. Secondly FICA and state. The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

The Peach States beer tax of 101 per gallon of beer is one of the highest nationally. Use this Georgia gross pay calculator to gross up wages based on net pay. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State.

After a few seconds you will be provided with a full breakdown. Georgia Georgia Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

Your average tax rate is 1198 and your marginal tax rate is. Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy. The money also grows tax-free so that you only pay income tax when you.

Ad Payroll So Easy You Can Set It Up Run It. The results are broken up into three sections. Federal Georgia taxes FICA and state payroll tax.

Well do the math for youall you need to do is enter. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull. Georgia has among the highest taxes on alcoholic beverages in the country.

Updated for 2022 tax year. Georgia Hourly Paycheck Calculator Results. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer.

However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Simply enter their federal and state W-4 information as. To begin with federal income is taxed at 1227 percent while state income is taxed at 462 percent. Lets go through your gross salary in further depth.

Paycheck Results is your gross pay and specific. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia. Skip to main content. To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Below are your Georgia salary paycheck results. Calculate your total income taxes. The state income tax rate in Georgia is progressive and ranges from 1 to 575 while federal income tax rates range from 10 to 37 depending on your income.

Supports hourly salary income and multiple pay frequencies. This includes tax withheld from.

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

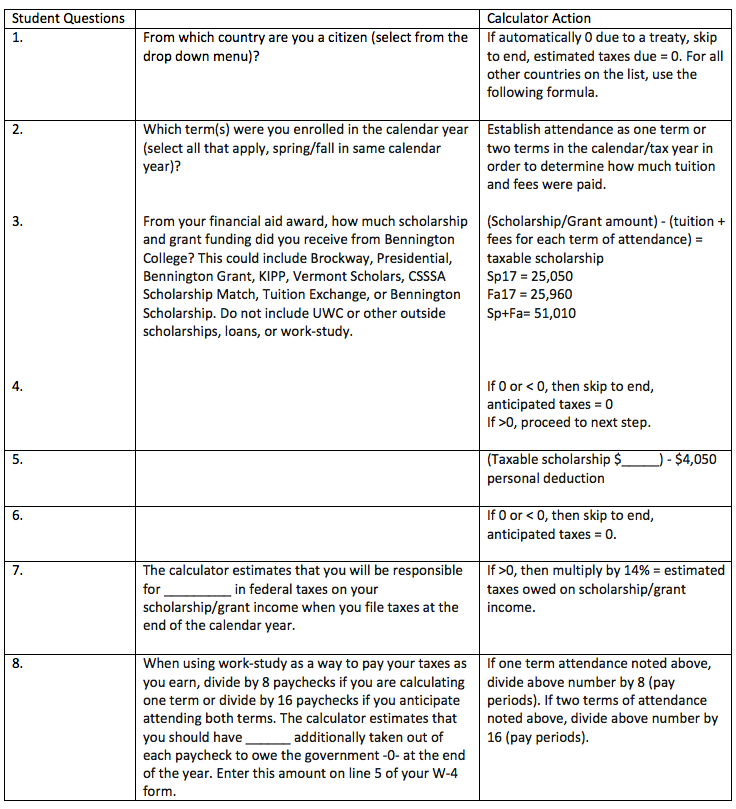

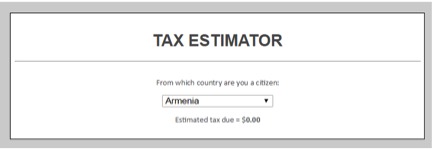

Tax Estimator For International Students Bennington College

Ohio Retirement Tax Friendliness Smartasset

How To Fill Out A Fafsa Without A Tax Return H R Block

Tax Estimator For International Students Bennington College

Individual Income Tax Colorado General Assembly

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Georgia Salary Calculator 2022 23

Cobb County Assessor S Office Cobb County Cobb County

Llc Tax Calculator Definitive Small Business Tax Estimator

Tarrant County Tx Property Tax Calculator Smartasset

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Tax Estimator For International Students Bennington College

King County Wa Property Tax Calculator Smartasset

Llc Tax Calculator Definitive Small Business Tax Estimator

Calculate Credit Card Balance Credit Card Interest Rate Ideas Of Credit Card Interest Rate Creditcard Interestra Dave Ramsey Budgeting Finances Budgeting

7 Ways To Create Tax Free Assets And Income